To retrieve your original agi from your previous years tax return you may do one of the following. Enter your agi in the box next to the enter last years agi line.

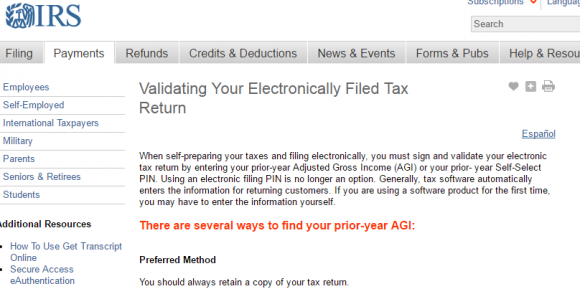

Use get transcript online to immediately view your agi.

/how-to-calculate-your-modified-adjusted-gross-income-4047216_final-c4dcde21c50f43fd915e310e9a00a3ae.png)

How to get agi from irs online.

There is a link to it under the red tools bar on the front page.

Use the get transcript tool available on irsgov.

The number is 800 908 9946.

You must pass the irs secure access identity verification process.

Once you have entered your agis click continue.

If you are filing a joint tax return enter the same agi for you and your spouse if you or your spouse did not file or efile a tax return last year enter 0 in the appropriate agi field.

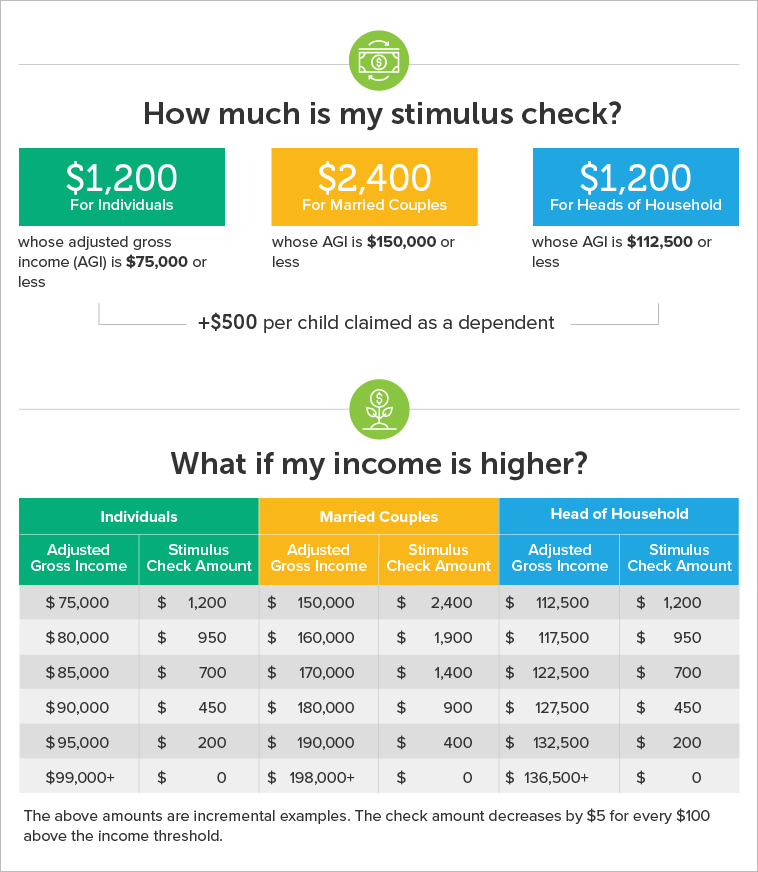

The irs defines agi as gross income minus adjustments to income depending on the adjustments youre allowed your agi will be equal to or less than the total amount of income or earnings you made for the tax year.

You can get various form 1040 series transcript types online or by mail.

Remember to consider all sources of income that contribute to your agi including.

If you need your prior year adjusted gross income agi to e file choose the tax return transcript type when making your request.

Use get transcript by mail or call 800 908 9946 if you cannot pass secure access and need to request a tax return transcript.

You must pass the secure access identity verification process.

Complete and send either form 4506 t or form 4506t ez to the.

Select the tax return transcript option and use only the adjusted gross income line entry.

To get a transcript people can.

If you only need to find out how much you owe or verify payments you made within the last 18 months.

Use the irs get transcript online tool to immediately view your prior year agi.

Select the tax return.

Wages on a w 2 or 1099 form.

/irsform4506-t-c2d3ddedde384dc28c9e0d91ebeb8c5f.jpg)

No comments:

Post a Comment