Otherwise remove collection accounts from your credit report by either writing a letter of good will to the creditor to have the item removed or by filing a dispute with the credit bureau creditor or both. The first step in removing a collection from your credit report is to identify if there are any.

Settle the debt and dispute it again.

How to get collections removed from credit report.

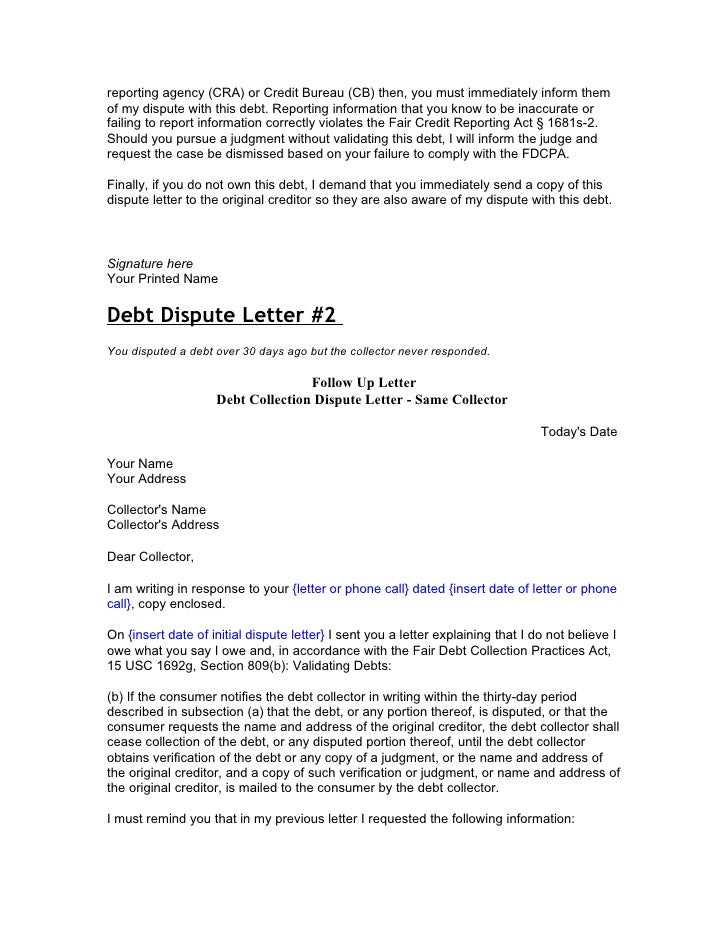

Ask the collection agency to validate the debt.

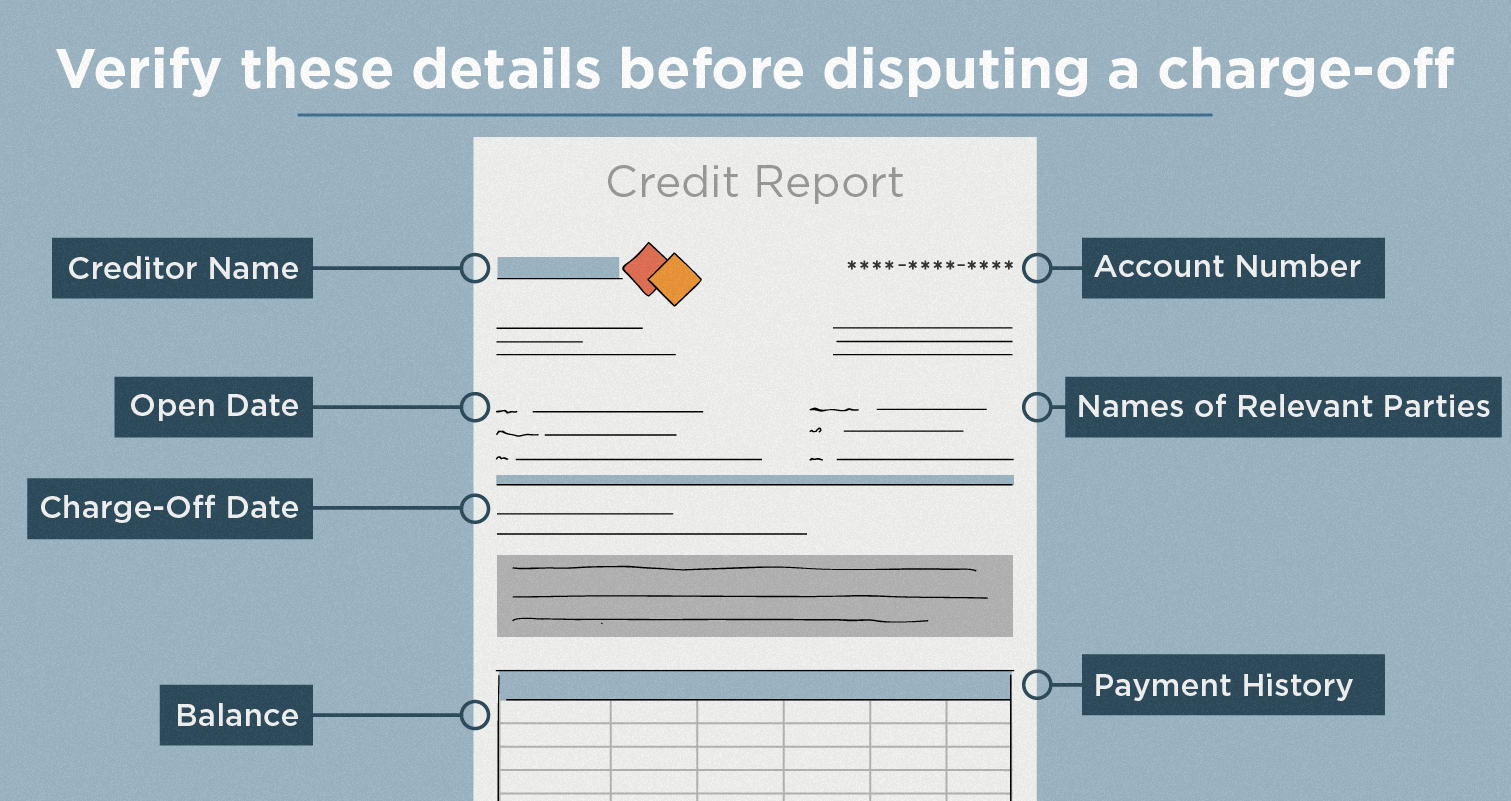

Once you have your credit report find the entry of the collection you want to be removed and verify every piece of information that is listed.

Sometimes collection agencies make this kind of offer but usually its the debtor who tries to negotiate a pay for removal deal.

This process requires the collector to provide proof that you owe the debt.

While it can be difficult to get collections removed from your credit report its not impossible.

If a collection is on your report in error dispute it.

Transunion will provide you with all your credit reports plus they include your credit score for free.

Ask for a goodwill deletion.

If the collector cant validate the debt or doesnt respond to your request the debt has to be removed from your credit report.

The original delinquency date is the date the account first became delinquent and after which it was never again brought current.

Wait for the account.

Get information on the debt from two places.

You must first obtain your credit report to check for any derogatory items.

Try to set up a pay for delete.

Here are the 6 steps to take to remove collections from your credit report 1.

Collections can be removed from credit reports in only two ways.

Once you have filed a dispute make sure to follow up with the credit bureau or creditor.

If you already paid the debt.

When youre trying to fix your credit having one or more collections can put a huge damper on getting your score on an upward trajectory.

How to get a collections stain off your credit report 1.

If youre wondering how to remove medical collections from your credit reports you may already be aware of the damage these types of accounts can wreak on your credit.

Medical collections can have a substantial negative impact on your credit scores as payment history is generally considered a high impact credit factor.

If the collection information is valid you must wait 7 years from the original delinquency date for the information to cycle off your credit reports.

For this method you will need a current copy of your credit report.

Dispute the account with the credit bureau even if its accurate.

If the debt collector first contacted you within the past 30 days you can request debt validation.

Consumers sometimes ask a collection agency to remove the collection account from their credit reports in exchange for payment.

:max_bytes(150000):strip_icc()/960563v1-5ba433644cedfd0050c28bf1.png)

/how-to-remove-a-charge-off-from-your-credit-report-960360_FINAL-d54108d9603a45aa853c03dbbae765bb.png)

:max_bytes(150000):strip_icc()/tactics-for-paying-off-debt-collections-960596-v3-5b8814c0c9e77c0025a6f156.png)

No comments:

Post a Comment