Use our international services page. Irs phone representatives are recently prohibited from providing a taxpayers agi over the phone.

Phone lines in puerto rico are open from 8 am.

How to get agi from irs on phone.

It takes an average of 106 minutes to get through these steps according to other users including time spent working through each step and contacting irs.

To get a transcript people can.

Use get transcript online to immediately view your agi.

Print and file your federal return by mail.

The number is 800 908 9946.

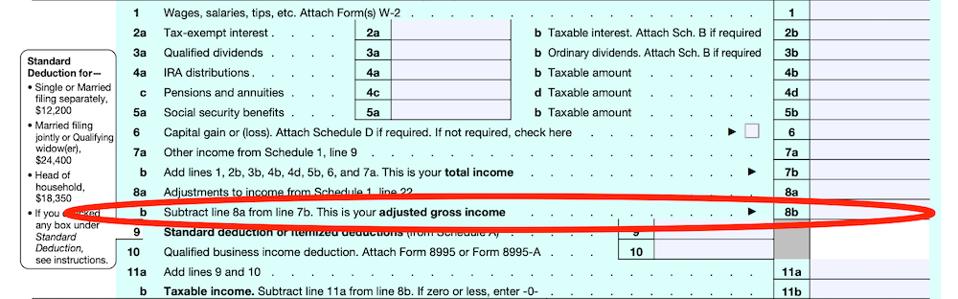

Once you get your tax transcript youll find your agi on the line that says adjusted gross income still cant find your agi.

Use the get transcript tool available on irsgov.

If you still cant find your agi you can always print your tax return and mail it to the irs.

Our help lines are open monday through friday.

So after first choosing your language then do not choose option 1 refund info.

If you only need to find out how much you owe or verify payments you made within the last 18 months.

Please allow 5 to 10 days for delivery.

You can make an appointment at an irs local office to get help.

When calling the irs do not choose the first option re.

1 800 829 1040 hours 7 am 7 pm local time monday friday.

Otherwise you can request a free transcript takes seven to 10 days to receive.

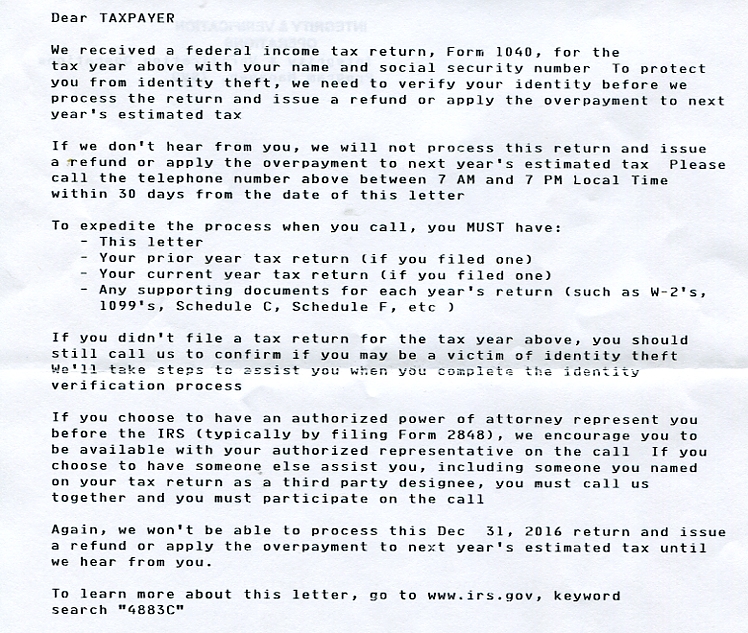

Once the irs has verified your identity they can give you your prior year agi over the phone.

It has 1 steps to it.

If you need your prior year adjusted gross income agi to e file choose the tax return transcript type when making your request.

Complete and send either form 4506 t or form 4506t ez to the.

If you can provide certain information to the irs name social security number ssn and current address you can receive the original agi amount over the phone.

Refund or it will send you to an automated phone line.

Select the tax return transcript and use only the adjusted gross income line entry.

There is a link to it under the red tools bar on the front page.

Once the irs has verified your identity they can give you your prior year agi over the phone.

And we tried to include a checklist of information youll need when you try to fix this yourself.

Residents of alaska and hawaii should follow pacific time.

You can request your agi by contacting the irs toll free at 1 800 829 1040.

You can get various form 1040 series transcript types online or by mail.

Alternatively you can call the irs telephone assistance line at 1 800 829 1040.

If you cant find a copy of last years return you can call 800 829 1040.

Use get transcript by mail or call 800 908 9946 if you cannot pass secure access and need to request a tax return transcript.

Choose option 2 for personal income tax instead.

Be sure your address is current and triple check your direct deposit information.

You must pass the secure access identity verification process.

Dont forget to sign and date the return and attach your forms w 2 on the left margin.

/how-to-calculate-your-modified-adjusted-gross-income-4047216_final-c4dcde21c50f43fd915e310e9a00a3ae.png)

No comments:

Post a Comment